DIAS INTERBANKING SYSTEMS S.A. launched its operations in 1989 and constitutes the national Automated Clearing House. The Company's shareholders are the Bank of Greece, credit institutions and legal entities, whose main object of business activity is means of payment, as follows:

DIAS has developed and is responsible for the operation of DIAS Payment System through which domestic and cross-border interbank payments are cleared and settled. DIAS Payment System includes the following payment schemes: credit transfers, direct debits, card payments, checks, and ATM transactions. Most credit, payment, or electronic money institutions operating in Greece participate in DIAS Payment System. At the same time, its connection to other payment systems operating within the Single European Payments Area (SEPA) provides access to Payment Service Providers within the Euro Area.

DIAS serves as the Greek hub of credit transfers and direct debits. These schemes that are designed in compliance with the specifications set by the second European Payment Services Directive (PSD2) and the Greek Law No 4537/2018, facilitate payments and fund collection procedures. DIAS is overseen directly by the Bank of Greece (BoG) and indirectly by the European Central Bank (ECB). DIAS Payment System also complies with the European Payment Council (EPC) SEPA payment schemes. DIAS offers its services to the Greek Public sector (National Social Security Fund-EFKA, Independent Authority for Public Revenue-IAPR, General Accounting Office, Cadastral Office, municipal water supply and sewerage companies, municipalities, etc.), as well as to the private sector (major electricity and telecommunication companies, insurance companies, companies in the betting industry, etc.).

The Company's Data Center provides a fully-featured, end-to-end solution that any bank or organization can use to access the DIAS Payment System. It is designed on a cutting-edge open architecture method. Hence, it complies with the latest messaging standards and supports multiple communication methods. In the Data Center, suitable and modern infrastructure has been established and solutions of high availability have been adopted, so that the Payment System operates uninterruptedly. In addition, DIAS functional Data Center offers third-party hosting services (Data Center colocation services).

DIAS has significant presence in the field of “account to account” transactions. In this context and in cooperation with Greek commercial banks, it introduced the IRIS Online Payments (for payments via mobile phone/computer) and IRIS e-commerce (for e-shop payments) products.

The Company’s strategy is to develop innovative payment solutions, in cooperation with the financial ecosystem. Its services are addressed to both the public and private sectors in order to contribute to payments modernization and strengthen the national economy.

In 1985, the Hellenic Bank Association formulated a plan to establish the national Interbanking Payment System (DIAS) for the purpose of promoting banking transactions and strengthening interbank competition, through interbank cooperation.

As a result of that initiative, on June 15, 1989, 14 commercial banks founded “DIAS INTERBANKING SYSTEMS S.A.” Over time, more credit institutions acquired a stake in the Company.

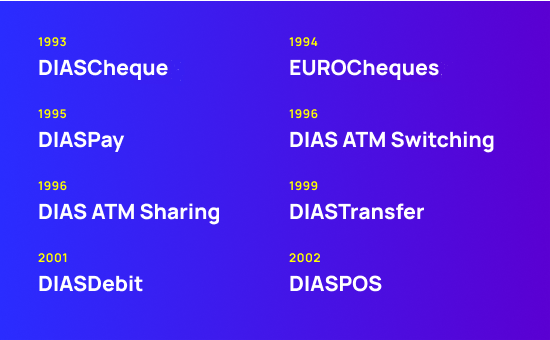

The period 1989-2006 was marked by the strategic decision to design the Company's Data Center and payment systems based on central IT systems. During this period, the individual payment systems, many of which were the precursor to current-day DIAS services, were designed and launched. Through these systems, DIAS initially provided services to banks, and in 1997, it began to provide services to the Greek government and other agencies as well.

In 1995, the Bank of Greece also became a shareholder.

Since 2007, the Company has expanded its connection to major agencies abroad and taken part in pan-European initiatives and Organizations. Some of these include the European Association of ACHs (EACHA) and SWIFT connection.

Connecting to equensWorldline.

Since May 2008, DIAS has been connected to the European Central Bank’s TARGET2 system to enable settlement of transactions handled through the Payment System. This system has already been expanded to instant payments, which allows Payment Service Providers to handle transactions in real time.

Connecting to EBA STEP2.

DIAS continues to develop its services and to undertake a number of projects aimed at improving its payment services. These include, for example, the reconstruction of the Data Center.

Connecting to the UnionPay card scheme.

Participation in the CAPS initiative. In doing so, the Company was able to develop its services and broaden their scope to the entire SEPA, as well as internationally to third countries.

Launch of the IRIS payments service. Development of an internet application portal.

Join the TARGET Instant Payment Settlement platform.

Since January 2021, DIAS joined the European group of clearance and settlement systems processing Instant Payments (SEPA Instant Credit Transfer), in accordance with the European Payment Council (EPC) specifications and is prepared to support Payment Service Providers in handling instant payments. Instant payments are electronic payments of small value that guarantee that funds are transfered from the payer to the benefiaciary instantly (within 10''), around the clock on any day (24/7/365).

A unified commercial brand name is established for IRIS services, marking the strategic consolidation of DIAS’s instant payments product identity.

The single brand name enhances the recognition and value of the IRIS brand, providing users with a clear and consistent message about using reliable, secure, and instant interbank payments.

Provision of a platform to Banks for the digital onboarding of businesses intending to connect with DIAS for RF/QR collections and IRIS Commerce.

DIAS joins the European Mobile Payment Systems Association (EMPSA), a European network of mobile payment providers.

This participation strengthens the company’s position within the European ecosystem and enables collaboration and interoperability with other mobile payment providers across Europe, fostering innovation in the field of digital transactions.

Establishment of an interbank RF payment standard to enable the gradual phase-out of non-RF payments.

Deployment of the QR code scanning feature in IRIS e-commerce and mobile redirection.

Launch of the Beneficiary Name Retrieval Service for IBAN verification in production.

Over 99% of businesses in Greece have now adopted the interbank RF/QR payment code for their collections.

This widespread adoption enhances interoperability, speed, and accuracy in payments, significantly improving the experience for both businesses and consumers.

Inclusion of the Cypriot banking community in the SEPA Instant Credit Transfer (SCT-Inst) scheme.

The number of registered freelancers and sole proprietors on the IRIS P2Pro service has surpassed 550,000, highlighting its growing adoption.

In September 2025, the IRIS P2P service surpassed 4,000,000 registered users in Greece, demonstrating its strong growth trajectory.

Its ease of use, speed, and security have made it a key tool for everyday transactions between individuals, supporting the digital transformation of person-to-person payments.

As of November 1st, all stores, whether physical or online, are mandated to accept instant payment methods, including IRIS Commerce.

To strengthen our pivotal role in the sector of electronic interbank payments.

At DIAS, sustainable development is inextricably linked to our mission: to ensure reliable, secure and transparent transactions that strengthen trust in the Greek financial system.

As an institutional organization operating at the heart of the economy, we adopt ESG principles (Environmental, Social, Governance) across every aspect of our activity, consistently investing in people, the environment and responsible corporate governance.

DIAS’s ESG strategy is an integral part of its corporate identity and reflects the way the organization operates, collaborates and evolves.

With a vision of connecting people, values and technology, DIAS continues to invest in initiatives that promote sustainable development, trust and positive change—for the economy, society and the environment.